RESOURCES

Case Studies

Learn how our clients are benefiting from Elevate Patient Financial Solutions' expertise, improving their patient experience and boosting their bottom lines.

Low Balance Insurance Follow Up Case Study

Learn how within five years of partnering with ElevatePFS, the client’s liquidation rate on its accounts of $5,000 and under had improvedby nearly 60%.

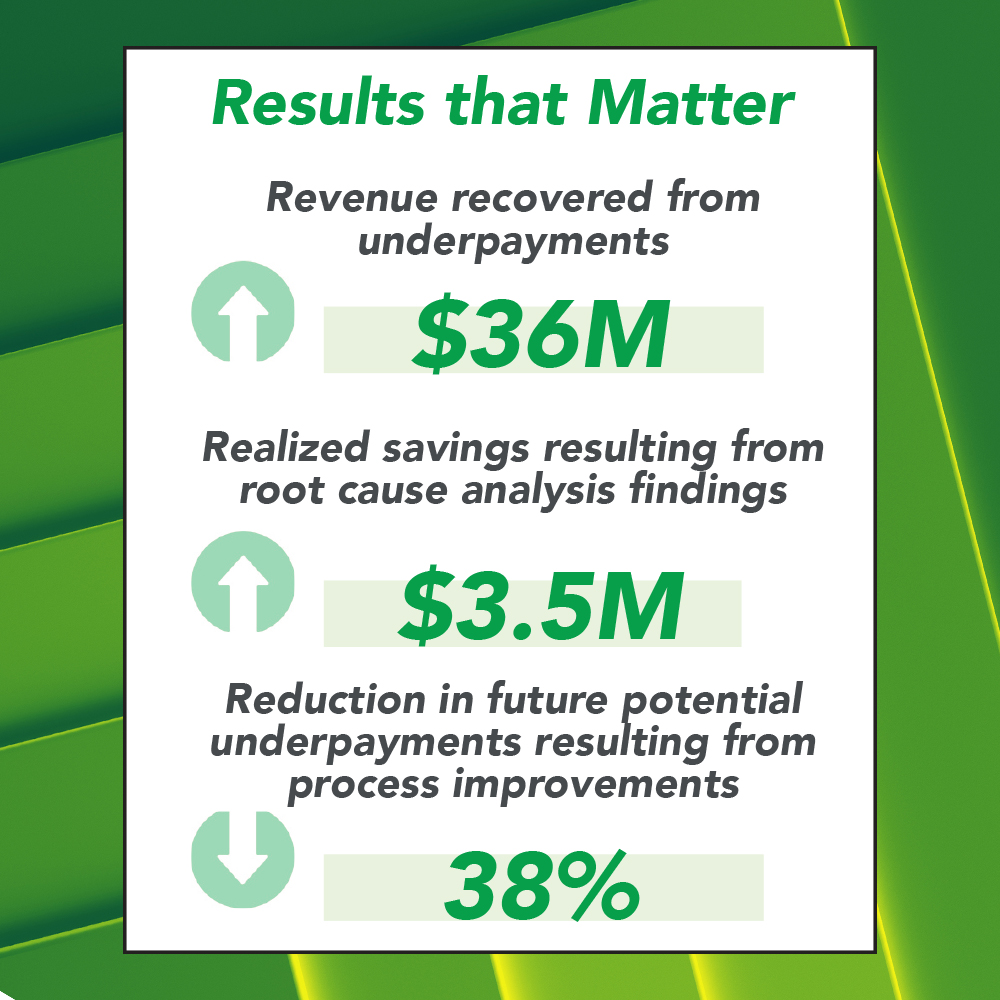

Payment Recovery Case Study

ElevatePFS’ revenue cycle expertise, specialized technology, and exceptional customer service enabled a client to optimize their revenue recovery from all their contracted payer contracts.

Accounts Receivable Services Case Study

ElevatePFS decreased a client’s A/R balance by 50%, outperforming another A/R vendor by producing double the collections for the same volume. For another client, ElevatePFS completed a $12 million work down in only seven months.