Accounts Receivable Services Case Study

Backlog/Ongoing Placements and Legacy Workdown Projects Completed with Exceptional Results

The financial stability of a healthcare provider depends on maintaining a positive cash flow. Often hospitals can only work a claim so far before the process stalls. When a trusted revenue cycle management partner is involved in claims follow-up, it becomes easier for providers to quickly and efficiently receive payments and recover on overdue payments.

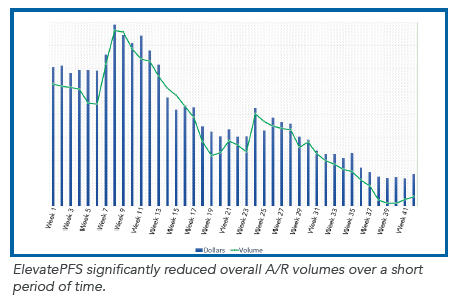

Elevate Patient Financial Solutions® offers comprehensive A/R follow up for all account types to support any revenue cycle strategy. It manages a hospital’s aging A/R inventory, working all types of accounts to resolution — clearing the backlog, preventing avoidable denials, and improving collections. The experienced and highly skilled ElevatePFS teams work with internal hospital staff to re-bill payers, appeal denials, and communicate with payers.

Click the button below to download the full case study and learn how ElevatePFS decreased A/R dollars by 50% for one client, and for another, liquidated $12 million of legacy work down in only seven months.