Third Party Liability Case Study

Healthcare Provider Partners with RCM Vendor to Improve Revenue Recovery on their Third Party Liability Accounts

Third-party liability insurance coverage is often the primary responsible payer for patients admitted to hospitals after an auto accident. For providers, this can be a complicated area to receive payment for care that is delivered. A 200-bed hospital in the South was looking for a revenue cycle management partner that had the expertise to identify and resolve patient accounts that may have resulted from an injury where potentially there could be a third party payer. Previously, the provider had outsourced the handling of their TPL accounts to another vendor, but the vendor had abruptly terminated their partnership with the provider.

The provider chose to partner with Elevate Patient Financial Solutions® to replace the previous vendor and ElevatePFS quickly ramped up their TPL services. The ElevatePFS implementation was completed in about 30 business days, half the time of a typical implementation.

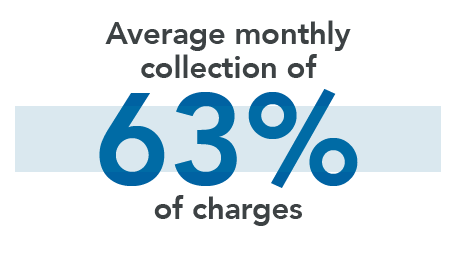

Click the button below to download the full case study and learn how ElevatePFS was able to fully optimize TPL account revenue recovery for this provider and deliver an average monthly collection of 63% of charges.