Out-of-State Medicaid Case Study

Strategic Vendor Partnership Helps Health System Improve Out-of-State Medicaid Processes and Increase Collections

An East Coast-based non-profit health organization with a network of hospitals, outpatient services, long-term care facilities and healthcare centers, found that an increase in out of-state Medicaid claims was bogging down its internal staff. They did not have the resources or the processes in place to work them and could not keep up with out-of-state Medicaid enrollments. Many of the system’s physicians, both directly employed with the organization and those who were contracted, were not credentialed in the states their patients lived. They needed a vendor to ensure their physicians were Medicaid-enrolled in these states before reimbursement could occur. The health system chose Elevate Patient Financial Solutions® to manage their Out of State Medicaid billing and enrollment and to build an effective process that would meet the organization’s goals.

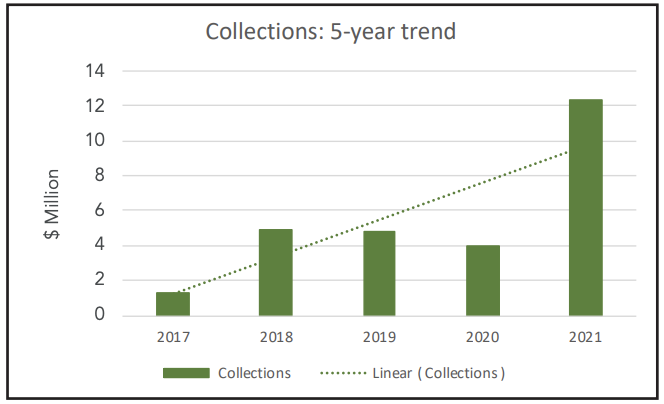

Click the button below to download the full case study and learn how by implementing border state and physician enrollment programs, ElevatePFS was able to increase reimbursement for the health system from a monthly average of $116k to more than $1.5M.