Eligibility Behavioral Health Case Study

Eligibility and Enrollment Services Result in Greater Reimbursement, Patient Retention, and Community Outreach for Behavioral Health Group

A large mental health services organization in the Midwest, serving multiple outpatient clinics in nine counties, wanted to improve access to care for self-pay clients. With limited resources to work with the uninsured or underinsured patient population, patient volumes were rising and many of the organization’s locations were not receiving payments for treating these patients. Leadership explored an outsourced solution based on the recommendation of a local mental health board. Elevate Patient Financial Solutions® was selected for its comprehensive Eligibility & Enrollment solution and ability to provide a patient-friendly Medicaid and Social Security Disability screening and quick turnaround of approved applications.

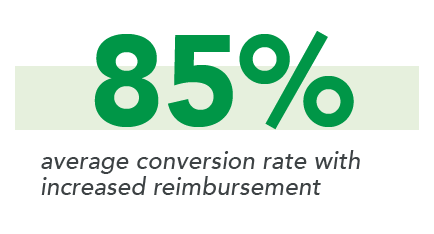

Click the button below to download the full case study and learn how the ElevatePFS eligibility and enrollment services implementation resulted in an average conversion rate of 85% and an increased patient retention of 18%.